“The world has changed and so has the world of development,” says Charley Freericks, senior vice president of Catellus Development Corporation. “Three years of living with COVID-19 has created new economic pressures, social inequities and a greater need for connection. People are looking for convenience. They want to work closer to home and live in a place with easy access to everything they need any time of the day or night.” As master developer of Novus Innovation Corridor, a 355-acre mixed-use development in downtown Tempe, Catellus believes the project will become a model for modern urban cities.

Christine Mackay, economic development director for the City of Phoenix, notes that these hyper-connected places — where people can live and walk to all the amenities they want and jump on mass transit to get to work — have long existed elsewhere in the country for a long time. “But Arizona had been so suburban for so long, and now, people who are relocating here, people who are staying here after they graduate, it’s that urban lifestyle they want,” she says. “And that’s what they’re demanding. And they’re bringing those really exciting opportunities with them along with the demand for them.”

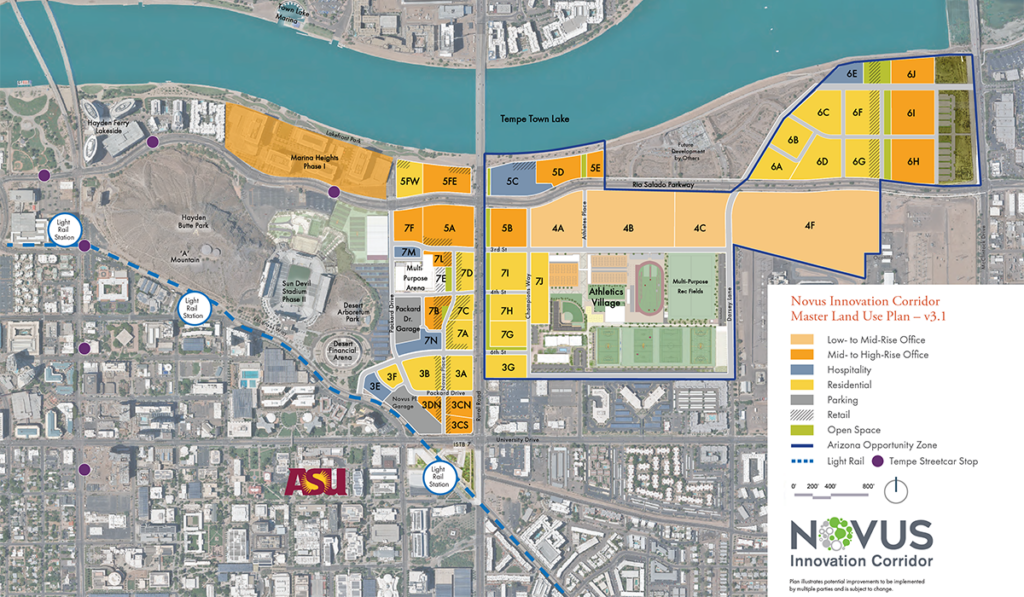

In the Phoenix metro area, Freericks believes Novus was a few years ahead in this vision of the urban live, work, play model. “Novus is a unique opportunity to develop the 21st-century urban community on an infill canvas in the center of one of the nation’s largest and fastest-growing metropolitan areas,” he says, noting the site’s proximity to freeways and countless transportation options makes getting in and out of Novus not only convenient for the resident or visitor, but keeps the community connected to the rest of the Valley.

“Traditionally, Phoenix has been developed as single-use assets,” says Ryan Timpani, managing director of JLL Phoenix. These could be a single office building on one parcel of land, with parking, or one apartment building possibly with some small amenities for the renters only but not open to the public, or a warehouse or a free-standing retail building. Attributing that simply to ample expansion opportunities with land relatively inexpensive to acquire, Timpani notes, “Traditionally, mixed-use is more expensive on a square-foot basis because it does require vertical development, which tends to be more expensive.”

Pointing out that another trend shaping mixed-use development is hybrid work, Freericks cites a prediction by McKinsey that nine out of 10 organizations will adopt a remote or hybrid work schedule for employees in the coming years. “This will have an impact on office design and utilization, including potentially leasing smaller spaces and reimagining large, unused areas as staff collaboration and event spaces,” he says. “Novus is shaped to include a plethora of office types to fit the end-user, from creative office parks like Rio Yards to Class A Premium builds that have specific amenities for officegoers.”

According to Freericks, Novus has made sustainability a top priority as well. “Sustainability is also a key consideration in the design of today’s mixed-use developments to combat climate change and bolster economic growth,” he says, noting that Novus is the first LEED-ND (Neighborhood Development) community certified at any level in Arizona and the community’s 777 Tower, a six-story building with office and retail space also earned LEED Gold-level USGB certification. “And we are devising effective solutions in transportation, resource and utility usage, and walkability.”

Plaza Companies CEO Sharon Harper observes, “Previously, the focus was on siloed bricks and mortar, and less about what could be labeled the ‘experience economy’ and ways to make projects have a different look and feel to them.” The trend in mixed-use now is “a more holistic approach that combines quality construction with an eye toward community.”

Different Looks of Mixed-Use

“The biggest trend we’re seeing — and working to be at the forefront of as well — is a more robust experience in mixed-use projects,” Harper says. This includes an expanded blend of services, entertainment, health and wellness features, environmentally friendly features, arts and culture and much more. “We’re currently seeing more of a focus on thoughtfully designed business and office environments, as well as a more synergistic mix of business and tenants — it’s the combination of office use with elements such as residential, hotels, education and retail.” And a blend of cool meeting places and great outdoor spaces combined with connectivity to transportation is important. She adds also, “We’re seeing more collaborations and partnerships between the public sector, private sector and even universities to create projects that celebrate the community’s history while enhancing what these projects can be.”

The goal for developers is to have a one-stop shop, says Timpani, explaining, “Ideally, if you’re a retailer or a landlord of an office building or the developer of an apartment building all in one, you’re going to want to keep the tenant onsite as much as you can.” If tenants live and work onsite, more often than not they’re going to shop and eat and dine on site, and spending dollars within several different buckets will support the overall health of the development. “It’s a symbiotic relationship between all three, plus or minus three or more phases, and they all feed into one another and they help one another prosper.”

What’s key is making sure the development includes active uses for both day and night, Mackay points out. “You can’t have a mixed-use development that is really active during the day and there’s no activity at night. Or there’s no activity during the day and it’s really active at night. Those don’t survive,” she says. “You have to have a mix of uses that keep it active both during the day and night.”

Mackay points to mixed-use projects in downtown Phoenix that are ground-floor retail then office in the middle and hotel on top, others across the region that are retail and residential. She names CityScape as an example of projects that combine retail, office, residential and a hotel, and Park Central for combining education, retail, office and hotel. “There’s such an incredible assortment of mixed-use projects that are really coming into fashion here in Phoenix,” she says.

One she cites as a “perfect example” is Laveen Towne Center at 59th Avenue and Dobbins, which recently completed a development agreement with the Phoenix City Council. It will be a 90-acre development from Vestar, the developer behind Desert Ridge Marketplace and Happy Valley Towne Center, among others. “Half of the project is really cool, like what you think of at Desert Ridge Marketplace, and the balance is high-density residential. Now it’s not, like it is in downtown, where the residential is over the retail; it’s really connected through these incredible paths that pull all the residential into the retail and the retail into the residential,” Mackay explains. “It’s on a more horizontal plane than a vertical plane, but still the same kind of mixed-use development. … As opposed to going down an elevator, I’m walking across a path.” Similarly, she says, Park Union, in Phoenix’s Deer Valley area, will have common, shared paths to allow people that are in the residential to walk straight into the retail without ever going out to a street.

Elements and Amenities

Mixed-use is different asset classes within an overall development. Traditionally, Timpani observes, that’s tended to be ground-floor retail — which is third-party leased by other businesses — with second story and above loft-style office and, potentially, multifamily apartments and/or hotels that may be contained in the same tower or be in an adjacent tower with a shared amenity deck. “But typically, the main indicator is some form of onsite retail in addition to other uses.”

And that is the trend Timpani says JLL is seeing nationally and globally “and certainly here in Phoenix”: The most in-demand commercial real estate developments, at least on the office-leasing side, are retail-led mixed use. “By that I mean those developments that have properly secured the appropriate retailers that have a good buzz — whether that’s fitness, really cool restaurants, really cool bars — those buildings that have office space as well end up having the most demand from the tenants.” He notes that demand is from tenants existing here in Phoenix as well as those companies looking to relocate here to the State of Arizona and Phoenix specifically.

The situation is slightly different for mixed-use that is not vertical, such as Mackay describes for Laveen Towne Center and Union Park. “In a horizontal, master-planned commercial development,” says Timpani, “retail doesn’t need to be on the ground floors so long as it’s in very close walking distance.”

“The office, retail and residential need to come as part of the first phase,” Mackay notes. There’s a symbiotic relationship. Residential creates the demand for retail (as the real estate truism goes, “Retail follows rooftops”). But as Mike Ebert, managing partner of RED Development explains, being able to provide great retail options increases the rent for office and multifamily. “The trends we’re seeing in mixed-use developments are the high quality of retail tenants and common amenities being a top driver attracting tenants.”

In fact, Ebert points out, retail is taking more space than before, and this leads to being able to produce more restaurant and retail options. “It’s not just a small amount of retail spaces at the base of an office or residential building as was the standard in the past.”

Harper notes that the focus on creating experiences that are memorable and enjoyable at mixed-use projects isn’t completely new — “But it has become more of a necessity for guaranteeing a project’s success.”

It’s no surprise, then, that Macky would point to restaurants as one of the biggest components of mixed-use development. “Because, whether you’re an office tenant looking for yourself or to take a client to, a hotel tenant, or a residential tenant looking to pick up something quickly and get it home before it gets cold, what do they all have in common? Everybody needs a place to eat.”

Mackay acknowledges that mixed-use development provides a great opportunity for local restaurants to be part of the fabric that we want them to be, noting that when people are traveling, ubiquitous national chains are not what they’re looking for. On the other hand, “When people are at work, Denny’s, for instance, is quick and you feel comfortable with it,” she observes.

“As developers are looking at their financing, chains are a much more bankable option with their capital,” Mackay explains. “If you put a chain restaurant in, the chain restaurant’s been around for 30 years — it’s bankable, it’s easy to finance.” When it comes to local restaurants — and she notes we are fortunate in having some incredibly well-capitalized local restaurants — she says, “Those cool, little mom-and-pop local restaurants that the community wants so badly in their mixed-use development, they are much better when they take second-generation space.” If the initial national chain tenant vacates for some reason, “the developer’s not taking such an incredible risk at building all of the infrastructure that a restaurant requires, which is much more expensive than most other types of retail development. And the developer now has an easier time convincing their lender to risk on a local restaurant.”

That situation is the same for other types of retail. “Our local retailers are those unique, one-of-a-kind ones that we all love and we get great things at for gifts and we take our guests to because ‘you’ve never seen anything like this before.’ They typically go in second-generation space because the developers stand a better chance of getting their projects financed when they have known, ‘credit worthy’ tenants,” says Mackay.

Then there’s hotels, which are also a big part of many mixed-use developments. Is there really that strong a demand? Mackay explains why the answer to that question is a resounding “yes.”

“We have 900,000 attendees for conventions every year, and we’re still busing people in from our outlying hotels because we don’t have enough hotel room in Downtown Phoenix,” she says. She points also to an extensive array of hospitals that include Dignity, St. Joseph, Norton Thoracic, Ivy Brain Tumor, Phoenix Children’s, Banner, the Cancer Center and the universities’ cancer centers, and destination business such as Rocket Mortgage, Integrate Software and WebPT who are “constantly bringing people in for overnight stays: clients, guests, meetings, events” and creating “a tremendous demand for hotel rooms in the central city. Across the full gamut and array of uses.”

For the outlying areas, Mackay points to more healthcare facilities and other businesses and notes that Metrocenter’s developer has already secured two hoteliers for the site. “And when you look at PV Mall — you kind of forget until you go driving around, how much business and office space there is in that employment corridor.” All of which creates a tremendous demand on the hotel rooms in the area.

“People are bringing in guests and need a place for them to stay. Or you want to go to a concert that’s happening in the amphitheater at PV Mall, and you decide to have a couple of glasses of wine and stick around and get a hotel room for the night and turn it in to a weekend. All those staycations are a tremendous demand on our hotel rooms.”

The situation is mirrored throughout the Valley. For instance, in the north Deer Valley area are longtime employers like Honeywell and American Express and “a huge number of new international employers with a huge international workforce — and they bring guests.”

Not to mention the demand for hotel accommodation from the construction itself for these new companies. Mackay points out, “We’re building so fast in this market that our contractors, our developers, are still bringing in construction firms from outside the region because they’ve got to get enough construction staff, so they put them up in hotels.”

Tenants

“The reason for a renewed emphasis on a mixed-use environment all has to do with the targeted consumer,” explains CBRE First Vice President Charlie von Arentschidt. “It’s not different, but it is receiving a renewed emphasis.” The renewed focus is reshaping what a “one-stop-shop” mixed-use site would look like for an employee, including an array of dining options and uses of convenience such as fitness operators or grocery stores.

Noting that higher-wage employers have always preferred an environment with dining options onsite or in close proximity and that these users now make up a disproportionate amount of the leasing volume, Arentschidt explains, “Owners and developers are trying to meet the expectations of these users. Additionally, many employers are searching for motivation to bring employees back to the office and believe that the amenities offered in a mixed-use environment will be a catalyst to return to work more fervently.”

As Timpani expresses it, “The office decision maker is going to want some dining, maybe some fitness option onsite and some possibility for some employees to live [there] so they can be encouraged to come into the office more.”

Of course, need for office space is a topic unto itself, with the debate among in-office, remote and hybrid workforce configuration, but Mackay shares, “I think the death of office has been greatly exaggerated. I don’t think we’re going to know what the new normal for office is until the end of ’23 or the beginning of ’24. I say that because I have everybody coming at me now and saying we should level all of our office and turn it into multifamily. I have a problem with that.

“But what I find so interesting,” she continues, “is the new, bright, shiny space in mixed use development.” She points to RED Development’s project at 44th Street and Camelback, which is comprised of hotel, restaurants, retail, residential and office. Calling it “gorgeous” with a lot of glass and natural light and amenities that the tenants are looking for, she notes the office component, before it completed construction — while it was at steel — became 100% occupied. “So, they were completely done with all of their leases while it was still under construction.”

From the tenant’s – and developer’s – point of view, “When people are trying to get their employees to want to come back to the office, they want to come back to some place where they feel good about being,” Mackay says. “And that new, or newly remodeled, office space is incredibly competitive.”

With the office market’s transactions currently dominated by any/all of three types of users — headquarters, client-facing office uses and higher-wage employment — Arentschidt says, “These users are willing to pay top-of-market rents in exchange for a best-in-class experience. Projects like The Grove on Camelback have leveraged the coming availability of onsite dining options, hotels and central proximity to attract users.”

“It used to be predominantly tech companies because you’d have a younger workforce that really was interested in mixed-use projects,” Timpani says. “But since the onset of the pandemic, in every single industry, every single business tenant is focused on winning the labor war and so being able to attract and retain the best talent — and so, you really need to have a really buzz-y development to move into.” Interest now is coming from Top 100 law firms, Top 5 accounting firms, global banks. “It’s as diversified from an industry perspective as you can imagine,” he says, “It’s a maelstrom of interest right now in mixed-use assets.”

Planning the Site

The interest from office tenants notwithstanding, Timpani notes that retail and multifamily typically tend to lead, with office coming after. He points out that with Block 23, for instance, JLL started with retail — the much-touted Fry’s grocery store. However, he says, what comes first depends on how the site’s situated. “If you have a big, grand entryway but that’s the only part of the parcel where office makes sense, like The Grove, you’d start with office.”

Aiming for an end result that creates the sought-after recipe of live-work-play elements that are desired by both tenants and users, “the Hines approach when evaluating a mixed-use masterplan is solely focused around the idea of placemaking,” explains Christina Maksimovic, director of development for Hines’ Phoenix Multifamily and Mixed-Use Masterplan.

In placemaking, Hines curates a mixture of uses to create an experiential destination with value created through thoughtfully integrated uses, intentional design, activated public spaces and communal programming. Specifically, this means the development reflects local culture and preferences such as selection of food and beverage options and the retail mix, provides elements of intentional design to create communal connectivity through activated public spaces, combines sought after elements of live-work-play to attract a wide range of users, and tailors programming to the area’s demographics to drive foot traffic and, in turn, increase dwell time at the asset. These characteristics are illustrated at 100 Mill in Tempe and at Metrocenter Mall in Phoenix.

“Placemaking is a departure from traditional mixed-use, integrated across products and led by curated ‘Main Street’ retail,” Maksimovic says. From a developer’s point of view, this type of product is attractive because a wide range of wide range of users favor service-based, experiential product characterized by seamless connectivity and there is a demonstrated premium over market with opportunities for ancillary income and enhanced tenant retention. As to tenant demand, Maksimovic says there is enhanced leasing velocity with employers seeking an amenitized environment to capture talent, retailers targeting footfall to drive sales, and residents valuing an array of convenient offerings.”

It is also market shaping, notes Maksimovic. “It’s a first-to-market product that creates a micro-market destination with differentiated offerings and scale,” she says. “It serves as a submarket anchor.”

Notable Mixed-Use Developments

Mackay points to Park Central as a great example of what happens in mixed-use development. “When I first got with the City of Phoenix in 2014, the office vacancy rate in this town was 38%. And when you’re talking a 13-million-square-foot office market, 38% is a lot of space. I kept telling people that Park Central was the hole in the donut. Until we knew what Park Central was going to do, the rest of midtown was not going to recover. And then Holualoa Plaza came along and really embraced the vision of what Park Central could be, and now it’s education with Creighton University’s medical school; it is healthcare; it’s office; it’s technology space; it’s restaurants, retail, residential — and it is just going gangbusters. We had planned it to be a 15-year buildout, and we’re only in year three, and already its two hotels are under construction, new restaurants are already under construction, Creighton’s done and operating, Dinerstein is nearly done with its first high-density residential project, and you’ve got more still to come.”

From a resident’s point of view, this kind of environment suits an urban lifestyle. So, Mackay admits she was surprised to find interest from residents outside the city core. “When we all started working really hard on this together a number of years ago, [we felt] we need to target our infill sites, our redevelopment sites, our old malls — the places that would make that common sense that you would find that night-and-day mixed-use redevelopment. And that’s where we really focused.

“And then, as we started to look at moving forward, we kept hearing from our more suburban areas, whether it was in Laveen or Norterra or Maryvale, our own citizens saying, “You’re bringing all this really cool day-and-night activity tenants into Downtown Phoenix, into the old malls and stuff, but we really want those kinds of spaces, too.”

The recently approved Laveen Towne Center is part of the city’s response to that interest. It will be a 90-acre development by Vestar at 59th Avenue and Dobbins. “That’s a more horizontal mixed-use development that is retail, restaurant and residential. And historic preservation,” she adds, noting Vestar will preserve the Hudson Historic Farmhouse as a restaurant or wine bar. “It’s a 100-year-old farmhouse that’s being preserved. That’s super cool.”

But the biggest projects currently are the mall redevelopments, says Mackay, pointing to RED Development’s redoing of PV Mall as a perfect example. It will be completed in multiple phases, with phase one currently under construction. “At ultimate buildout, this thing will be incredible. Restaurants, retail, office, hotels, fitness, movie theater, open space, transit — across the board, there won’t be a use you can think of — it’s probably easier to say what won’t be there,” she says. “There won’t be any industrial, let’s put it that way.”

RED Development’s Ebert says PV Mall is set to attract elite office tenants and luxury residential occupants. “This is a newer trend that we’ve seen across our portfolio in recent years; we’ve noticed it especially accelerate within the last two years,” he says. “Our main goal with mixed-use developments is to create amazing destinations for people to live, work and play. This shift in the market aligns perfectly with our vision for the future core of Paradise Valley and how this project is set to transform the community with an array of dining, entertainment and retail experiences along with luxury residential offerings and state-of-the-art office campuses.”

Metrocenter Mall, previously mentioned in this article, is another major project. A partnership between Concord Wilshire Capital and Hines, it is a billion-dollar redevelopment mixed-use project that will combine restaurant, retail, hotels, residential, parking, open space, movie theater and entertainment.

Mackay points to CityScape and Block 23 in Downtown Phoenix — which is office, hotel, residential, retail, restaurant, multifamily, parking, art space, open space and park — as “incredibly successful.” And Timpani adds to the list with Scottsdale Quarter — there’s “some of the better shopping” along with apartments onsite and office above retail — and SkySong, which has hotel, multifamily, office and retail onsite.

Novus Innovation Corridor adds another element to the concept. Freericks describes Novus as “the intersection where business and research meet to create a unique opportunity for collaboration and synergy with Arizona State University,” which, he points out, is ranked as the nation’s “Most Innovative University” by U.S. News and World Report. Located adjacent to ASU’s Tempe campus, Novus will provide businesses with an opportunity to gain access to a skilled pipeline of employees, research facilities as well as with other high-profile industry leaders. Also, Freericks says, “At Novus, entrepreneurial startups to global enterprises in emerging industries will find a home. So will researchers at the newly christened Walton Center for Planetary Health that puts science and sustainability front and center.”

Once thought of as a collection of buildings and spaces, mixed-use developments like Novus are becoming mixed-use destinations. “From the early stages of planning, Novus was envisioned as such,” Freericks says. “Again, Novus had the opportunity to refine, rather than react to, the industry changes. Here, people can spend less time in their cars and more time outdoors in public parks, walking along shaded pathways and enjoying a host of amenities that enable them to live life to the fullest. At the end of the day, Novus is a community in which people not only live, work, shop and dine, but a gathering place where they come to make memories and enjoy unique experiences.”

Freericks reports that Novus Place, the community’s vibrant retail district that will span 275,000 square feet, has also captured interest from a variety of restaurants and retailers. It is being designed with a livable, walkable main street to be the hub of activity for the community, with a mix of events and entertainment that include a host of college athletics events, concerts and more.

“Phoenix is a very horizontal city just because there’s no impediment to external growth, with the amount of available dirt we have to build on,” Timpani observes. “So, as a byproduct, we’re not a very dense city. We don’t have a plethora of mixed-use opportunities, so those that do afford that mixed-use nature — live, work, play — are top of mind with businesses and corporations as they look to house their future home.”

So today’s successful projects, Harper points out, creatively combine traditional elements with a backdrop of arts and culture, unique experiences and exceptional amenities. “It’s about what makes for an exciting venue for living, entertaining, working, enjoying the environment and experiencing the arts,” she says. “Plaza Companies has proven the theory with our work at Park Central and SkySong, the ASU Scottsdale Innovation Center — the attraction of companies and tenants has far exceeded the typical office building lease-up and the retention and growth of companies located there.”

The Future for Mixed-Use

“Phoenix is a commuter city. Everybody drives,” says Timpani. Walkable developments have been few and far between, so, he says, “mixed-use could be different here from New York City or San Francisco.”

But that walkability aspect could be changing. Says Mackay, “We’re talking to a number of developers, and when they’re looking at mixed-use development, they’re talking now about creating these completely self-contained mixed-use projects. You don’t even need a car.

“There’s a developer that does a phenomenal job with that: Culdesac. It’s a completely self-contained development. It’s more on the residential side and the amenities that come to support the residential than it is a true mixed-use project. But as an example, the market’s already there,” Mackay points out. She notes 35% of the residents in Downtown Phoenix do not own a car; instead, they use ride share, they get a Zip car, they use Light Rail, they walk, they ride their bikes. So, to create those opportunities in a less dense urban environment like the Norterra area, Laveen or Maryvale, she says, “If there’s enough demand by residents and by businesses that want to be in an area where they are completely self-contained, everything that you need is just right there.”

Mixed-use development will likely continue to be a hot product. “The demand so far outpaces the supply for mixed-use assets, there’s really no ceiling on where rental rates can go,” Timpani says. “Not that you can name your own price,” he adds, “but that demand is across the board, on office, multifamily and retail if you have that great homogenous environment.

“Those developers who are creative and forward-thinking and are seeing this mixed-use trend are getting paid back in spades by way of the most demand, the least amount of vacancies and the highest rental rates,” Timpani says. “We’re seeing that in Phoenix, in every city and municipality in the Phoenix metro and in every other MSA. It’s not unique to the Sunbelt and it’s not unique to gateway cities; we’re seeing it across the board.”